The commerce relationship between China and the USA has loads of friction. However a minimum of one space is booming: Chinese language start-ups trying to set up a presence within the West are spending billions of {dollars} for ads on companies owned by a few of Silicon Valley’s greatest expertise firms.

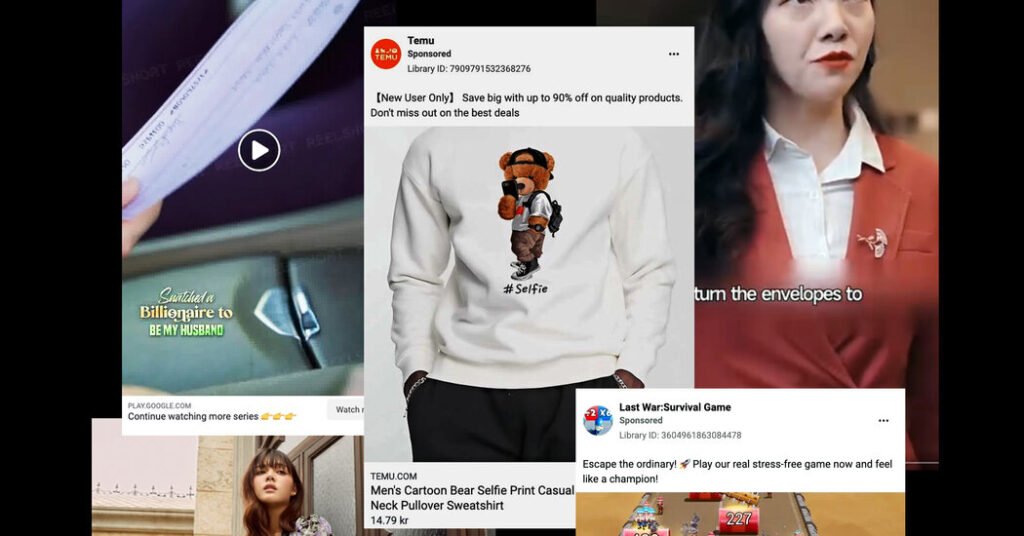

Temu, the worldwide arm of the Chinese language e-commerce large Pinduoduo, is flooding Google with adverts for absurdly cheap items. With an preliminary public providing looming, the fast-fashion service provider Shein is inundating Instagram with adverts for garments and equipment at rock-bottom costs. Builders of China’s video streaming and gaming apps are dumping advertising {dollars} into Fb, X and YouTube to entice potential customers.

Meta, the mother or father firm of Fb and Instagram, stated on a name with analysts that Chinese language-based advertisers accounted for 10 p.c of its income, nearly double over two years in the past. Within the final yr, Temu has positioned about 1.4 million adverts globally throughout Google companies, and a minimum of 26,000 completely different variations of adverts on Meta, in keeping with Meta’s Advert Library.

“What firms like Temu have performed is absolutely simply open a hearth hose of cash that it’s pouring into adverts,” stated Sky Canaves, senior analyst for retail at eMarketer. “You may’t escape their adverts throughout Fb, Instagram and Google Search.”

The surge in spending exhibits how interconnected China and the USA stay, regardless of vigorous efforts by every nation to be extra self-reliant. The Chinese language firms are having access to huge audiences of customers, and the Silicon Valley firms are earning profits off a market they’re in any other case not doing enterprise in.

The advertising blitz is fueled by the worldwide ambitions of Chinese language start-ups. At residence, the financial system is now not rising by leaps and bounds because it had for years, and corporations are topic to a thicket of presidency guidelines which have quashed their development.

The crackdown on corporations just like the e-commerce large Alibaba and the as soon as high-flying trip share supplier Didi underscored the message that an organization, regardless of how profitable, may be dropped at its knees if it runs afoul of the Chinese language Communist Occasion and its chief, Xi Jinping.

“There’s a restrict on the diploma that an organization can develop in China,” stated Andrew Collier, founding father of Orient Capital, an financial analysis agency in Hong Kong. “Xi Jinping is completely pleased for Chinese language firms to earn money abroad so long as they toe the road inside China.”

However going world comes at a value. It’s arduous to garner important quantities of digital consideration with out paying Google’s mother or father firm, Alphabet, and Meta. Collectively, the 2 firms promote a majority of all web promoting largely by way of their on-line properties like Google Search, YouTube, the Google Play App Retailer, Fb, Instagram, WhatsApp and Messenger.

For probably the most half, Alphabet’s and Meta’s merchandise usually are not accessible in China. Efforts to supply their companies in China meant abiding by Chinese language authorities censors, which brought on worker protests at each firms.

Alphabet and Meta have such important attain in the remainder of the world that Chinese language corporations are actually going to them.

The push of spending by Temu and Shein has “single-handedly” pushed up the price of digital promoting, Josh Silverman, chief government of Etsy, stated on a name with analysts in November.

Low cost Chinese language e-commerce firms have grabbed rising consideration in the USA over the previous few years, tempting patrons with low-cost items when inflation was driving up costs.

Temu opened its U.S. website in September 2022. It bought issues like a garlic press for $2 or a cotton swab dispenser for $1.50. Temu is now accessible in 50 international locations.

With the slogan “Store Like a Billionaire,” Temu has been a voracious purchaser of all types of promoting, from low-cost Fb adverts to dear spots in the course of the Tremendous Bowl. Temu has the deep pockets of PDD Holdings, which operates Pinduoduo.

Bernstein Analysis estimates that Temu spent $3 billion on advertising final yr. In a lawsuit filed towards Shein in December, Temu stated it served about 30 million every day customers in the USA. Temu’s app is probably the most downloaded on each Apple’s and Google’s app shops, in keeping with Sensor Tower, an app analytics agency.

Shein, which entered the U.S. market about seven years in the past, can be persevering with to spend aggressively on advertising. It doesn’t promote merchandise in China, though it was based in Nanjing and depends closely on Chinese language sellers and the nation’s provide chain.

It has run about 80,000 adverts throughout Google prior to now yr alone, together with product ads that seem subsequent to go looking outcomes. On Meta, Shein has greater than 7,000 ads lively, in keeping with Meta’s Advert Library.

For Temu and Shein, spending closely on Fb won’t assure success. Practically a decade in the past, Want, one other buzzy e-commerce app targeted on low-cost items sourced from China, spent lots of of thousands and thousands of {dollars} on Fb adverts. However the retail app did not maintain the curiosity of buyers. Final month, Want was bought to Singapore’s Qoo10, one other e-commerce platform, for $173 million, one-hundredth of its public providing valuation in 2020.

Shein and Temu permit third-party sellers to add product photos on to Meta’s promoting programs, and have these merchandise inside their adverts on Instagram and Fb. These adverts, that are focused to customers’ pursuits based mostly on Meta’s huge troves of information, are typically simpler at luring buyers.

The advert spending shouldn’t be restricted to retailers. In latest months, Instagram has develop into inundated with previews of brief addictive dramas — cleaning soap operas for customers with restricted consideration spans. Every episode is normally a minute lengthy, with the collection working about 80 to 100 episodes.

The exhibits are typically overly dramatic, with grabby titles like “The Double Life of My Billionaire Husband” or “30 Days Till I Marry My Husband’s Nemesis.”

These brief dramas are fashionable in China, and a handful of firms — apps like Reelshort, DramaBox and FlexTV — are competing to export this type of leisure. As a substitute of promoting month-to-month subscriptions like, say, Netflix, the short-content apps use a mannequin just like on-line video games, requiring customers to buy what are generally known as cash that can be utilized to pay for episodes. A viewer may earn cash by watching commercials.

Just like video games, these apps require a gradual stream of customers to get hooked on samples of the packages and really feel compelled to maintain spending to see how the present ends. On Meta, DramaBox is working greater than 1,000 lively adverts, in keeping with Meta’s Advert Library, whereas Reelshort and Flex TV are working lots of of adverts.

One other main Chinese language advertiser on Meta is a Hong Kong-based recreation developer referred to as First.Enjoyable. The developer appears to be blanketing Fb, Instagram and even X with adverts to advertise its flagship recreation, Final Battle: Survival, with lots of of paid previews.

The previews have enticed gamers to obtain the app. It’s the fifth-most-downloaded app on Google Play and twelfth on Apple’s App Retailer.

Sensor Tower estimated that the sport generated $22 million in income final month.

Advertising on platforms like Meta has given the sport builders a lifeline to clients exterior the nation because the Chinese language authorities has made it more durable to do enterprise. The newest instance was in December when Chinese language regulators introduced plans to restrict how a lot cash folks might spend on on-line video video games. The company drafting the plans backed off its preliminary proposals within the face of protests, however Beijing has been adopting an more and more more durable stance towards the sport business.

The message has not been misplaced on recreation builders. On its web site, Beijing Yuanqu Leisure, First.Enjoyable’s mother or father firm, stated it was targeted purely on abroad markets, as a result of it “firmly believes that China’s web business will proceed to internationalize.”

Claire Fu contributed reporting.