House costs have held up higher than anticipated amid excessive rates of interest. However that doesn’t imply the housing market is wholesome.

When the Federal Reserve started elevating rates of interest in 2022, most economists thought the housing market can be the primary to undergo the implications: Increased borrowing prices would make it dearer to purchase and to construct, resulting in decreased demand, much less development and decrease costs.

They have been proper — at first. Development slowed, however then picked up. Costs hiccuped, then resumed their upward march. Increased charges made houses tougher to afford, however Individuals nonetheless wished to purchase them.

The result’s a housing market that’s completely different, and stranger, than the one described in economics textbooks. Elements have proved surprisingly resilient. Different elements have seized up virtually utterly. And a few appear perched on a precipice, susceptible to tumbling if charges keep excessive too lengthy or the economic system weakens unexpectedly.

It’s also a market of stark divides. Individuals who locked in low charges earlier than 2022 have, usually, had their house values soar however have been insulated from larger borrowing prices. Those that didn’t already personal, however, have typically had to decide on between unaffordable rents and unaffordable house costs.

However the state of affairs is nuanced. Householders in some elements of the nation face skyrocketing insurance coverage prices. Rents in some cities have moderated. Builders are discovering methods to make new houses reasonably priced for first-time patrons.

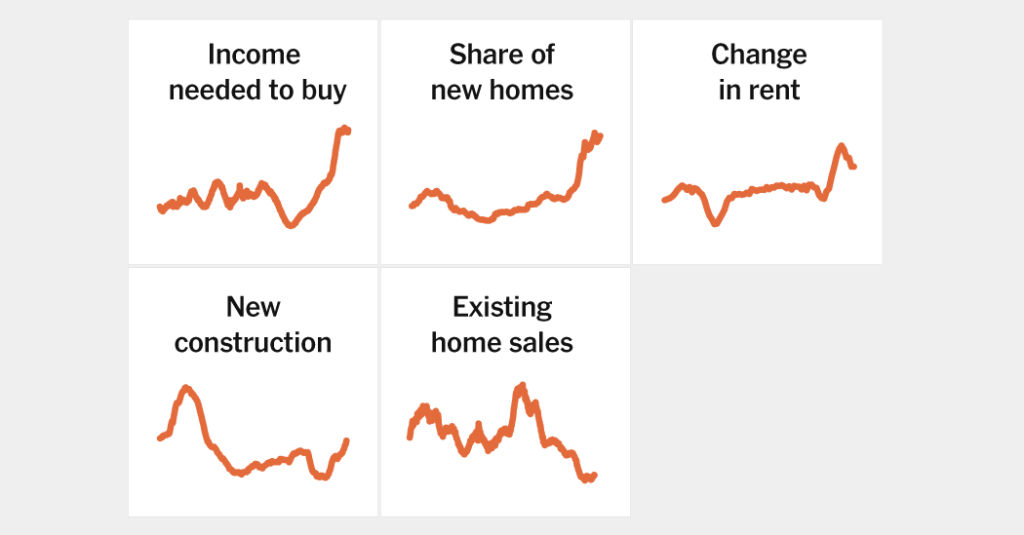

Nobody indicator tells the total story. Somewhat, economists and business specialists say understanding the housing market requires an array of knowledge shedding gentle on completely different items of the puzzle.

1. It’s onerous to discover a house to purchase.

The speedy rise in rates of interest pushed down demand for housing, by making it dearer to borrow. However it additionally led to an enormous drop in provide: Many house owners are holding onto their houses longer than they’d in any other case as a result of promoting would imply giving up their ultralow rates of interest.

This “charge lock” phenomenon has contributed to a extreme scarcity of houses on the market. It isn’t the one issue: House constructing lagged for years earlier than the pandemic, and retired child boomers have been selecting to remain of their houses reasonably than shifting to retirement communities or downsizing to condominiums as many housing specialists had anticipated.

Many economists argue that the shortage of provide has helped maintain costs excessive, notably in some markets, though they disagree concerning the magnitude of the impact. What is definite is that for anybody hoping to purchase, discovering a house has been extraordinarily tough.

2. Houses are unaffordable.

House costs, already excessive, soared throughout the pandemic, rising greater than 40 p.c nationally from the tip of 2019 to mid-2021, based on the S&P CoreLogic Case-Shiller value index. They’ve risen extra slowly since then, however they haven’t fallen as many economists anticipated when the Fed began elevating rates of interest.

Rising rates of interest have put these costs even additional out of attain for a lot of patrons. Somebody shopping for a $300,000 home with a ten p.c down cost may anticipate to pay about $1,100 a month on a mortgage in late 2021, when rates of interest on a 30-year, fixed-rate mortgage have been about 3 p.c. In the present day, with charges at about 7 p.c, that very same home would value about $1,800 a month, a rise of about 60 p.c in month-to-month prices. (That doesn’t even bear in mind the rising value of insurance coverage or different bills.)

Economists have other ways of measuring affordability, however all of them present just about the identical factor: Shopping for a home, notably for first-time patrons, is additional out of attain than at any level in a long time, or possibly ever. One index, from Zillow, reveals that the standard family shopping for the median house with 10 p.c down may anticipate to spend greater than 40 p.c of their revenue on housing prices, nicely above the 30 p.c that monetary specialists suggest. And in lots of cities, corresponding to Denver, Austin and Nashville — by no means thoughts longtime outliers like New York and San Francisco — the numbers are a lot worse.

3. New houses are filling (a few of) the hole.

Maybe essentially the most shocking improvement within the housing market over the previous two years has been the resilience of new-home gross sales.

Builders usually battle when rates of interest rise, as a result of excessive borrowing prices drive away patrons whereas additionally making it dearer to construct.

However this time round, with so few current houses obtainable on the market, many patrons have been turning to new development. On the similar time, many huge builders have been in a position to borrow when rates of interest have been low, and have been ready to make use of that monetary firepower to “purchase down” rates of interest for purchasers — making their houses extra reasonably priced while not having to chop costs.

In consequence, gross sales of latest houses have held comparatively regular at the same time as gross sales of current houses have plummeted. Builders have particularly sought to cater to first-time patrons by constructing smaller houses, a phase of the market all of them however ignored for years.

It isn’t clear how lengthy the pattern can proceed, nonetheless. Many builders pulled again on exercise when charges first rose, leaving fewer new houses within the pipeline to return to market within the years forward. And if charges keep excessive, it could get tougher for builders to supply the monetary incentives they’ve used to draw first-time patrons. Personal builders in Could broke floor on new houses on the slowest charge in almost 4 years, the Commerce Division mentioned on Thursday.

4. Rents are unaffordable, too.

Rents skyrocketed in a lot of the nation throughout the pandemic, as Individuals fled cities and sought area. Then they stored rising, because the sturdy labor market elevated demand.

Rising rents helped gas an apartment-building growth, which has introduced a flood of provide to the market, notably in Southern cities like Austin and Atlanta. That has led rents to rise extra slowly and even to fall in some locations.

However that moderation has been sluggish to work its method by the market. Many tenants are paying rents negotiated earlier within the housing cycle, and the brand new development has been concentrated within the luxurious market, which doesn’t do a lot to assist middle- or lower-income renters, at the least within the brief time period.

All of that has produced a rental affordability disaster that retains rising worse. A record share of renters are spending greater than 30 p.c of their revenue on housing, Harvard’s Joint Middle for Housing Research discovered just lately, and greater than 12 million households are spending greater than half their revenue on hire. Affordability is now not only a downside for the poor: The Harvard report discovered that hire is changing into a burden even amongst many households incomes greater than $75,000 a yr.

5. A shift could also be underway.

For a lot of the previous two years, the housing market — particularly for current houses — has been caught. Consumers can’t afford houses until both costs or rates of interest fall. Homeowners really feel little strain to promote, and aren’t desirous to grow to be patrons.

What may break the logjam? One risk is decrease rates of interest, which may carry a flood of each patrons and sellers again to the market. However with inflation proving cussed, charge cuts don’t seem imminent.

One other risk is a extra gradual return to regular, as house owners determine they’ll now not delay long-delayed strikes and grow to be extra prepared to chop a deal, and as patrons resign themselves to larger charges.

There are indicators which may be starting to occur. Extra house owners are itemizing their houses on the market, and extra are chopping costs to draw patrons. Builders are ending extra new houses and not using a purchaser lined up. Actual property brokers are sharing anecdotes of empty open homes and houses that sit in the marketplace longer than anticipated.

Hardly anybody expects costs to break down. The millennial era is within the coronary heart of the home-buying years, that means demand for houses must be sturdy, and years of under-building imply the nation nonetheless has too few houses by most measures. And since most owners have loads of fairness, and lending requirements have been tight, there isn’t more likely to be a wave of compelled gross sales as there was when the housing bubble burst almost 20 years in the past.

However that additionally implies that the affordability disaster isn’t more likely to resolve itself quickly. Decrease charges would assist, however it is going to take greater than that for homeownership to really feel achievable to many youthful Individuals.