Jerome H. Powell, the chair of the Federal Reserve, indicated on Tuesday that current inflation knowledge had given the central financial institution extra confidence that worth will increase have been returning to regular, and that continued progress alongside these strains would assist to pave the best way towards a central financial institution price minimize.

“The Committee has acknowledged that we don’t count on it will likely be applicable to scale back the goal vary for the federal funds price till we’ve got gained higher confidence that inflation is transferring sustainably towards 2 p.c,” Mr. Powell stated.

He added that knowledge earlier this 12 months failed to offer such confidence, however that current inflation readings “have proven some modest additional progress, and extra good knowledge would strengthen our confidence that inflation is transferring sustainably towards 2 p.c.”

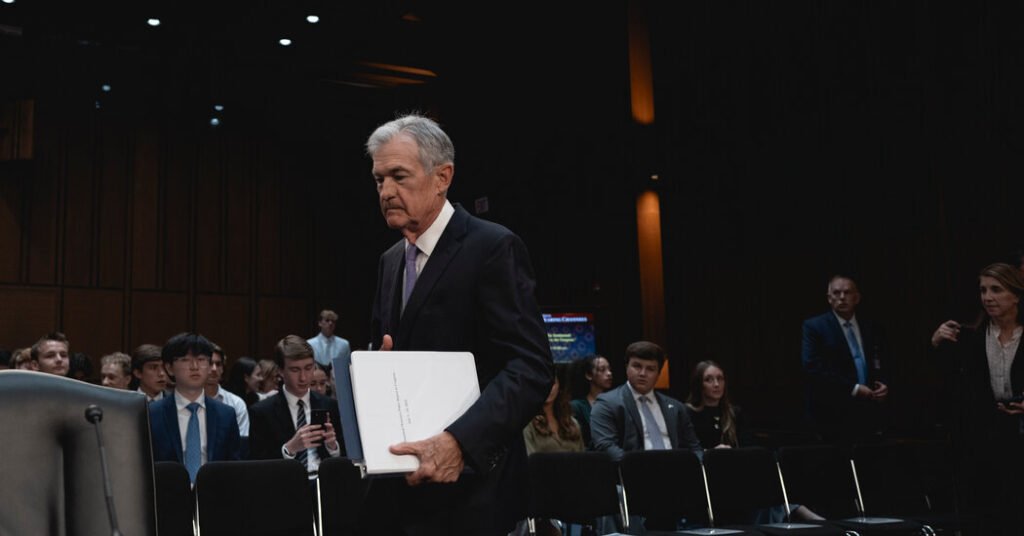

Mr. Powell delivered the remarks on Tuesday in an look earlier than the Senate Banking Committee. Whereas Mr. Powell prevented zeroing in on a particular month for when the Fed would possibly start to chop rates of interest, he additionally did little to push again on rising expectations {that a} reduction could come in September. Fed officers meet in late July, however few economists count on a transfer that early.

Mr. Powell stated he was “not going to be sending any indicators concerning the timing of any future actions” in response to a lawmaker query about when price cuts would possibly come.

The chair’s congressional testimony got here at a fragile second for the central financial institution. Fed officers try to determine when to start chopping rates of interest, which they’ve held on the highest price in many years for roughly a 12 months now. However as they weigh that alternative, they have to strike a cautious stability: They need to preserve borrowing prices excessive lengthy sufficient to chill the economic system and absolutely stamp out fast inflation, however in addition they need to keep away from overdoing it, which might crash the economic system an excessive amount of and trigger a recession.

“If we loosen coverage too late or too little, we might damage financial exercise,” Mr. Powell stated. “If we loosen coverage an excessive amount of or too quickly, then we might undermine the progress on inflation. So we’re very a lot balancing these two dangers, and that’s actually the essence of what we’re enthusiastic about as of late.”

Whereas Fed officers spent 2022 and far of 2023 centered on beating again inflation, even when that got here at an financial value, worth will increase have cooled sufficient that they’re now clearly taking the trade-offs between cooling inflation and weakening the labor market into consideration.

After leaping to 9.1 p.c in 2022, Shopper Worth Index inflation is predicted to fade to three.1 p.c as of a June studying set for launch this Thursday. Importantly, costs at the moment are climbing very slowly on a month-to-month foundation, an indication that inflation is coming again below management.

“After a scarcity of progress towards our 2 p.c inflation goal within the early a part of this 12 months, the latest month-to-month readings have proven modest additional progress,” Mr. Powell stated.

The inflation slowdown has come partly as a result of provide chains have healed from pandemic-related disruptions, permitting items costs to fall. However the progress additionally owes to a continued cooling within the broader economic system.

That moderation in financial progress ties again to Fed coverage. Beginning in March 2022, central bankers raised rates of interest quickly to their present 5.3 p.c earlier than leaving them on maintain at that elevated stage. That has made it costly to borrow to increase a enterprise, to purchase a automobile or to buy a home — tamping down financial demand.

The job market can be slowing after years of peculiar power. Job openings have been regularly coming down after spiking following pandemic lockdowns, and the unemployment price has been ticking steadily increased. Wage progress can be pulling again, an indication that employers aren’t paying up as a lot to compete for brand new hires.

“Within the labor market, a broad set of indicators means that situations have returned to about the place they stood on the eve of the pandemic: robust, however not overheated,” Mr. Powell stated.

Altogether, Mr. Powell’s feedback painted an image of an economic system that was transferring towards the Fed’s objectives regularly, doubtlessly permitting for the mild comedown that central bankers had been hoping to realize. Whereas it’s uncommon for the Fed to crush critical inflation with out inflicting a recession, officers have been optimistic that they may handle to drag it off on this episode.

Mr. Powell additionally fielded questions on a significant Fed financial institution regulation proposal, known as “Basel III Endgame,” which has stoked disagreement amongst regulators and drawn outcry from banks and their lobbyists. Fed officers have been clear that they plan to make large modifications to the proposal, and banking teams need regulators to completely re-propose it.

“It’s the strongly held view of members of the Board that we do must put a revised proposal out for remark for some interval,” Mr. Powell stated, later suggesting that the brand new remark interval could be one thing like 60 days.

“We’re working via that query with” different regulators, he stated. “We’re ready to maneuver ahead once we do attain settlement on that.”

Mr. Powell additionally confronted questions concerning the housing market, which is combating a scarcity of stock. Some lawmakers have blamed the Fed for that: As a result of mortgage charges have gone up a lot with increased rates of interest, many individuals are avoiding transferring, selecting as an alternative to remain put and maintain on to their low fastened charges. Dwelling constructing has also pulled back.

“For housing provide, the very best factor that we are able to do is get inflation below management in order that charges can come again down,” Mr. Powell stated. “Insurance policies to extend housing provide are actually not a lot within the arms of the Fed, they’re within the arms of legislatures, state and federal.”

Mr. Powell will testify on Wednesday earlier than the Home Monetary Companies Committee.