Within the week heading into the primary quarter earnings report for its 2025 fiscal yr (FY), Lam Analysis Corp. NASDAQ: LRCX inventory was down almost 15%. Moreover, analysts had been reducing their worth targets for LRCX inventory over issues of slowing development that will make it troublesome to see the inventory outperforming the market.

Nevertheless, the inventory is reversing course with a achieve of over 4% in early buying and selling the morning after the corporate’s earnings report. Is that this a brief elevate or an indication that Lam Analysis could also be proving its naysayers fallacious? Get Lam Analysis alerts:Signal Up

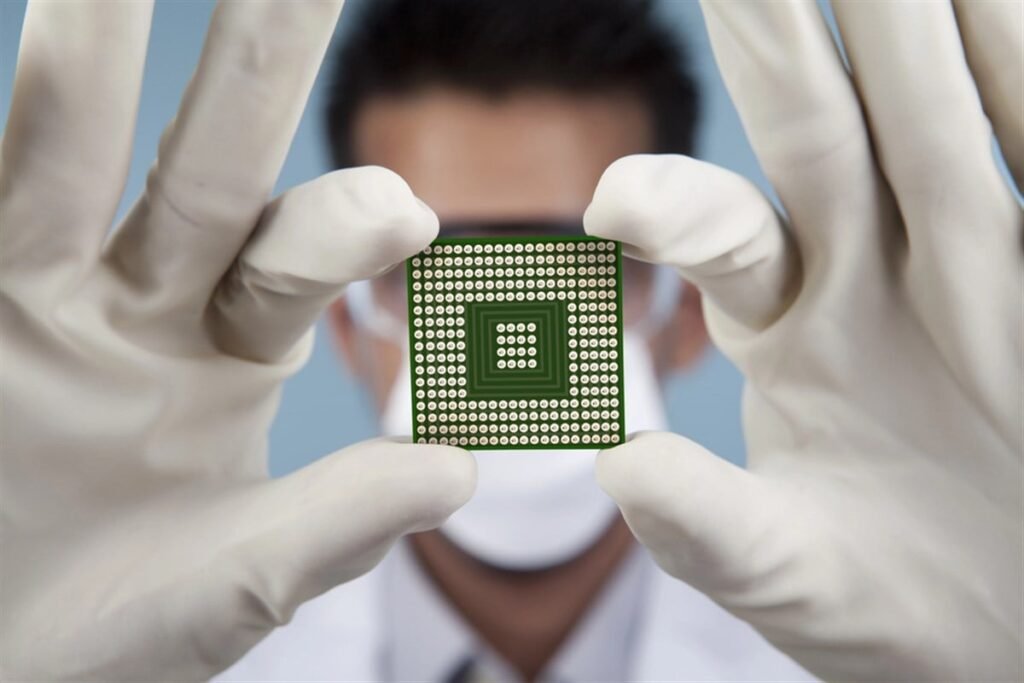

Earlier than reviewing what got here out of the earnings report, it’s necessary to get a way of what the corporate does and why that’s important for buyers. Semiconductors have been a unstable sector within the final 4 years, largely to the upside. That’s as a result of this can be a sector that gives the “picks and shovels” that permit firms to construct out their synthetic intelligence (AI) infrastructure.

Lam Analysis in flip makes wafer-fabrication tools and associated providers that the chipmakers want. In a world the place extra chips are wanted in smaller areas, Lam’s etch and deposition machines permit chips to be stacked vertically.

Lam Analysis At this time$77.68 +1.11 (+1.45%) (As of 10/25/2024 ET)52-Week Vary$57.44▼$113.00Dividend Yield1.18percentP/E Ratio26.79Price Goal$97.03

A Bullish Reversal Could Be in Play

Analysts aren’t essentially bearish on LRCX inventory. Heading into earnings, the consensus worth goal for the inventory was $141.28. That instructed a rise of over 90% in 12 months. And it comes after the corporate accomplished a 10-for-1 inventory cut up in October.

However the issues weren’t with out some benefit. Previous to the fourth quarter of FY2024, Lam Analysis had delivered a number of quarters by which income and earnings got here in decrease yr over yr (YOY). This is smart when you think about the place the corporate is within the semiconductor chain.

Many chipmakers had been forecasting slower development. If firms want fewer picks and shovels, these firms will want fewer handles and spades.

Nevertheless, the development shifted within the fourth quarter of FY 2024. This got here at a time when many chipmakers began to improve their inner forecasts. However as buyers know, one time doesn’t make a sample. That is why it’s important that that is now two consecutive quarters the place Lam Analysis delivered a YOY beat on income and earnings.

Lam Analysis Co. (LRCX) Worth Chart for Sunday, October, 27, 2024

Synthetic Intelligence Continues to Present a Tailwind

The headline numbers within the firm’s earnings report confirmed topline income of $4.17 billion, greater than the $4.06 billion that analysts had been anticipating. On the underside line, Lam delivered earnings per share (EPS) of 86 cents, above expectations of 81 cents.

Though the corporate received’t provide full-year steerage till subsequent quarter. It did undertaking its second-quarter income to be $4.3 billion, which is greater than the present forecast for $4.22 billion. The corporate is forecasting EPS of 87 cents, which is above estimates for 85 cents.

And in keeping with Lam Analysis’s president and chief government officer, Timothy Archer, it’s demand for AI purposes that may proceed fueling this development. Though not giving particular numbers, the corporate sees sturdy development in modern logic nodes (NAND) in addition to areas equivalent to high-bandwidth reminiscence (HBM).

LRCX Inventory Could Have Confirmed Help

Nevertheless, whereas it could be too early to go all in on the inventory, it’s necessary to notice that the bounce after earnings could also be confirming a double backside for the inventory round $72 per share. The query is whether or not the inventory will proceed to maneuver greater. At one level in pre-market buying and selling the inventory climbed close to $78 earlier than pulling again to round $75. Earlier than you think about Lam Analysis, you will wish to hear this.MarketBeat retains observe of Wall Avenue’s top-rated and greatest performing analysis analysts and the shares they advocate to their shoppers each day. MarketBeat has recognized the 5 shares that prime analysts are quietly whispering to their shoppers to purchase now earlier than the broader market catches on… and Lam Analysis wasn’t on the record.Whereas Lam Analysis presently has a “Reasonable Purchase” ranking amongst analysts, top-rated analysts consider these 5 shares are higher buys.View The 5 Shares Right here Development shares provide numerous bang in your buck, and we have got the following upcoming superstars to strongly think about in your portfolio.Get This Free Report

Like this text? Share it with a colleague.

Hyperlink copied to clipboard.