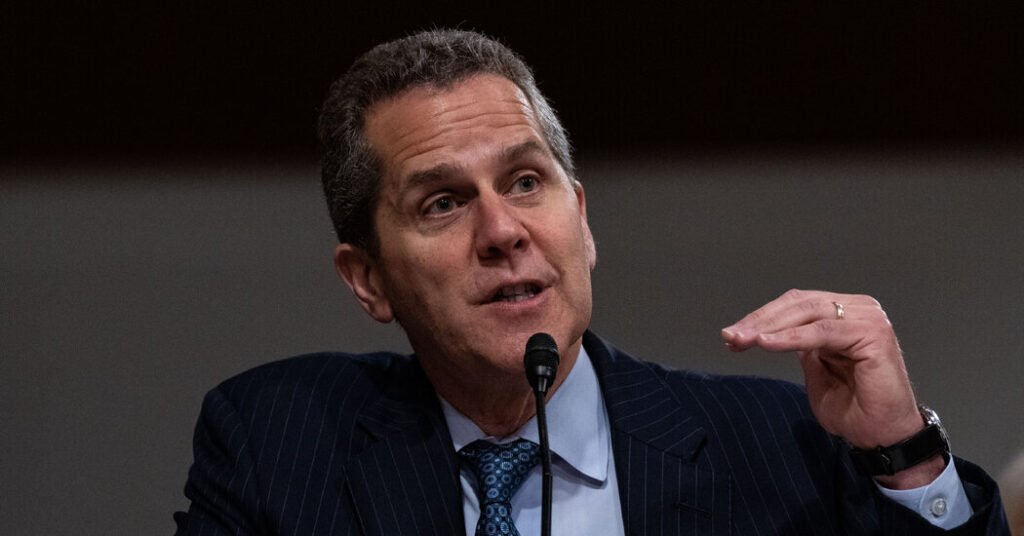

Michael Barr will step down from his position because the Federal Reserve’s vice chair for supervision by Feb. 28, or sooner if President-elect Donald J. Trump appoints a successor, the Fed said on Monday.

Mr. Barr will proceed to serve on the central financial institution’s Board of Governors. However in an interview, Mr. Barr mentioned the choice to go away his position as vice chair of supervision was supposed to sidestep a protracted authorized battle with Mr. Trump that he believed may injury the central financial institution.

Some people hooked up to the Trump administration wished to fireside Mr. Barr earlier than his time period as vice chair expired, in accordance with folks conversant in the matter who spoke on background due to the sensitivity of the problem.

That might have resulted in a prolonged — and dear — authorized battle over whether or not an incoming president has the authority to take away somebody from a Senate-confirmed place at an unbiased company.

Some monetary regulatory consultants questioned why Mr. Barr — and the Fed itself — would enable a political change to affect who served in a strong position. Jerome H. Powell, the Fed’s chair, has made a degree of claiming that the Fed is unbiased of the White Home and that its choices will not be influenced by politics. Mr. Powell has additionally insisted that Mr. Trump lacks the authorized authority to fireside him from his position as Fed chair, which can also be confirmed by the Senate.

“I’m shocked by Barr’s announcement, as a result of I anticipated him to withstand Republican requires his ouster and make a degree of defending the Fed’s independence,” Ian Katz, managing director at Capital Alpha, mentioned in an e-mail.

Mr. Barr mentioned he and his legal professionals believed that he would prevail in courtroom if Mr. Trump had been to try to take away him. However he concluded that the battle wasn’t value waging due to the hurt it may inflict on the Fed.

“If it got here to litigation on the deserves, I’d win,” Mr. Barr mentioned. The larger query, he mentioned, was, “Do I need to spend the subsequent couple of years preventing about that and is that good for the Fed? And what I made a decision was that no, it’s not good for the Fed, it might be a severe distraction from our potential to serve our mission.”

Mr. Barr mentioned the choice was not straightforward. “The query I wrestled with is a troublesome query, and in some ways it was a painful choice.”

By voluntarily stepping down, Mr. Barr additionally avoids testing whether or not Mr. Trump — or any president — has the authority to fireside a Senate-confirmed official. Each Mr. Barr and Mr. Powell have mentioned that the regulation precludes Mr. Trump from eradicating them from their posts. However that view has but to be examined within the courts. A ruling permitting Mr. Trump to fireside Mr. Barr may have opened the door to Mr. Powell’s firing, an concept the president-elect flirted with throughout his first time period.

His departure will successfully freeze any financial institution regulatory actions till Mr. Trump names somebody to the vice chairman position. In saying his transfer, the central financial institution mentioned: “The Board doesn’t intend to take up any main rulemakings till a vice chair for supervision successor is confirmed.”

The mixture of Mr. Barr’s choice to step down, mixed with the moratorium, struck some monetary regulatory consultants as particularly problematic.

“The Fed traditionally, zealously guards its independence,” Aaron Klein, the Miriam Ok. Carliner chair and senior fellow in financial research on the Brookings Establishment. “I discover it unusual that the Fed wouldn’t solely tacitly appear to assist this choice by Barr, however go additional and announce a moratorium on rule making.”

Mr. Klein famous that if Mr. Trump opted to not choose anybody for a yr or extra, it may successfully chill financial institution rule making indefinitely.

Dennis Kelleher, the president, chief govt and co-founder of Higher Markets, a nonprofit that pushes for more durable monetary regulation, known as Mr. Barr’s choice “stunning” and mentioned it might hinder the Fed’s position in overseeing the protection and soundness of the monetary system.

“His baseless capitulation to deregulation zealots will, in reality, destroy that mission faster and extra totally than any dispute over the place,” he mentioned.

Mr. Barr’s transfer comes after a tumultuous tenure overseeing regulation and supervision of the nation’s largest banks. Mr. Barr oversaw an try and rewrite monetary guidelines that will have elevated the sum of money that banks will need to have on the prepared.

The overhaul would have required the most important banks to extend their cushion of capital — money and different simply accessible belongings that might be used to soak up losses — which Mr. Barr mentioned would guarantee banks may stand up to durations of extreme turmoil.

The proposal — and Mr. Barr — instantly got here underneath assault from all kinds of teams, together with the banking {industry}, lawmakers and even a few of his colleagues on the Fed. Two of the Fed’s seven governors, each Trump appointees, voted against the principles.

Mr. Barr finally watered down the proposal in September after acknowledging the blowback.

“Life offers you ample alternative to study and relearn the lesson of humility,” Mr. Barr mentioned at an occasion that month.

Whereas Mr. Trump has not introduced any plans to attempt to exchange Mr. Barr, the president-elect has made clear he plans to take an industry-friendly stance towards banks, echoing his administration’s strategy throughout his first time period. Mr. Trump’s vice chair of supervision, Randal Ok. Quarles, labored to loosen financial institution supervision throughout his tenure.

Even earlier than Mr. Barr introduced his choice to go away, there was widespread hypothesis that the financial institution proposal, referred to as Basel III endgame, wouldn’t acquire closing approval in a Trump administration.

The adjustments should be collectively agreed upon by the Fed, the Federal Deposit Insurance coverage Company and the Workplace of the Comptroller of the Foreign money. Mr. Trump has the chance to appoint the administrators of the F.D.I.C. and O.C.C., although he has not but mentioned whom he plans to call.

Senator Tim Scott, the South Carolina Republican who will head the highly effective Senate Banking Committee, welcomed Mr. Barr’s choice to step down, citing the blowup of Silicon Valley Financial institution and different regional companies within the spring of 2023 in addition to the Basel III guidelines.

“From his supervisory failures through the spring 2023 financial institution failures to the disastrous Basel III endgame proposal — Michael Barr has failed to satisfy the obligations of his place,” Mr. Scott mentioned in a press release. “I stand able to work with President Trump to make sure now we have accountable monetary regulators on the helm.”