It’s not a family identify fairly but, however anybody who follows the inventory market is aware of no less than a bit about Nvidia.

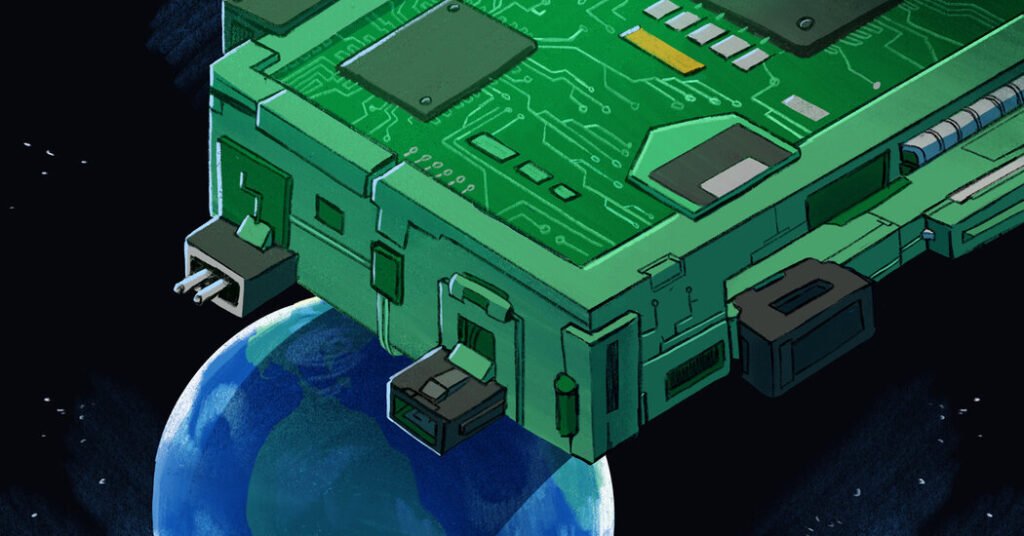

The corporate is the marvel of the yr, a inventory by which all others are measured. Nvidia designs the chips that make synthetic intelligence work, and since A.I. is being hailed as crucial technological improvement for the reason that web, Nvidia shares have been rocketing since final yr.

I’m not certified to evaluate how necessary — or how harmful — A.I. will in the future turn into, however I do pay shut consideration to the inventory market, which values Nvidia at greater than $2.2 trillion, making it the third-largest public firm on this planet behind Microsoft and Apple.

Enthusiasm for A.I. is elevating the share costs not solely of Nvidia, but in addition of many different tech firms which can be believed to be imbued with the know-how’s potential, together with Microsoft, Meta and Alphabet in addition to different chipmakers like AMD, Taiwan Semiconductor and Intel.

However the blistering charge of Nvidia’s beneficial properties — a rise of about 290 % over the previous 12 months — has me and lots of Wall Avenue analysts questioning how sustainable this run is. The reply has implications for your complete market.

There are various methods to look at this, together with conventional inventory evaluation, which considers gross sales, earnings, money move, enterprise development and momentum. I took an offbeat strategy: asking a number of A.I. chatbots about Nvidia’s prospects as a inventory. Particularly, I requested how massive Nvidia’s market worth could be in a decade if the corporate’s share value stored its present tempo.

What they instructed me amounted to this: Nvidia inventory’s sharp rise can’t proceed like this for very lengthy. And since a lot of the inventory market is sure up in the identical feverish A.I.-driven inventory frenzy, the message is broadly true. If the market doesn’t decelerate quickly, it could inflate itself right into a bubble — and all bubbles finally burst.

On a private degree, I really like new tech however I attempt to not turn into too enthusiastic about it till I’m assured it really works safely and reliably. From what I can inform, A.I. produces spectacular pictures and is enjoyable to play with, but it surely’s neither dependable nor secure (but).

(The New York Instances sued OpenAI and Microsoft in December for copyright infringement of stories content material associated to A.I. programs.)

What’s in a quadrillion?

To their credit score, all three of the A.I. chatbots I requested — Microsoft Copilot, powered by OpenAI’s Chat GPT-4; Google Gemini; and Anthropic’s Claude 3 — had been reluctant to reply my questions straight.

Every one mentioned it couldn’t assess inventory valuations reliably or predict with the slightest diploma of accuracy how a inventory or the general market would carry out sooner or later. I want human inventory analysts mentioned as a lot.

Simply because Nvidia’s inventory value is rising quick now doesn’t imply it would continue to grow quick, and definitely not over intervals so long as a decade, all of them warned me.

However I pressed them to carry out some fundamental calculations anyway, which I backstopped with Twentieth-century know-how — a spreadsheet and a calculator.

The chatbots didn’t arrive on the identical numbers each time and by no means agreed on the small print. That’s one other signal, in my humble estimation, that they’re not prepared for prime time. I wouldn’t use them for math homework.

However on this case, the small print didn’t actually matter. In the end, and with appreciable prompting, all of them got here up with the identical fundamental conclusion: The straightforward legal guidelines of compound arithmetic inform us that if the corporate’s share value retains rising at its present charge, Nvidia will find yourself with a market cap within the quadrillions of {dollars}.

Quadrillions are an order of magnitude I’m not comfy with, so I resorted to a dictionary: One quadrillion {dollars} is 1 with 15 zeros after it, or a thousand trillion {dollars} in American parlance. (In British English, a quadrillion is even larger: 1 with 24 zeros. I’m utilizing the American definition.)

How massive is that? The world economic system — the mixed dimension of the entire annual gross home merchandise of each nation on the planet — amounted to $100.88 trillion in 2022, in keeping with the World Bank. So if Nvidia stored rising at its present annual charge, it could dwarf the output of your complete identified financial universe inside 10 years.

Claude 3, the Anthropic A.I. chatbot, calculated that Nvidia, at its present development charge, would turn into a $2.76962 quadrillion firm in 10 years, after which warned me: “That is an awfully giant quantity that appears implausible in actuality, as it could make Nvidia bigger than your complete international economic system many occasions over.”

In plain English, Nvidia’s astonishing development charge over the previous yr is much too excessive to proceed for lengthy. I’d be cautious about shopping for shares of Nvidia, or some other inventory, within the perception that its momentum is perpetual. What goes up can come down, and, someplace down the road, it definitely will.

This warning reinforces what conventional valuation measures present. Nvidia’s share value, and the costs of many shares, are excessive. They are often justified on the belief that their gross sales and earnings will develop at a rip-roaring tempo. But when share costs rise sooner than earnings, the market get together will finally crash.

Keep in mind Apple?

Nvidia is a formidable firm. Its merchandise have an important popularity and are in excessive demand, and it generates monumental, quickly rising earnings.

Its newest earnings report in February, which unleashed super inventory market optimism, contained eye-popping numbers. And in a dialog with Wall Avenue analysts then, Jensen Huang, Nvidia’s chief government, gave Wall Avenue one thing thrilling to mull over. The corporate’s know-how is offering the foundations for a brand new industrial revolution, he mentioned.

“We at the moment are at first of a brand new trade the place A.I.-dedicated knowledge facilities course of large uncooked knowledge to refine it into digital intelligence,” he mentioned. “Like A.C. energy era crops of the final industrial revolution, Nvidia A.I. supercomputers are basically A.I. era factories of this industrial revolution.”

The sky is the restrict for the following couple of years, he advised.

However Nvidia will inevitably start to develop extra slowly. It’s absurd to suppose it might probably turn into larger than all the pieces else within the universe.

However it might nonetheless develop swiftly. Some firms have managed to maintain long-term fast development earlier than.

Apple, at varied levels since its founding in 1976, has perplexed skeptics who’ve periodically mentioned it had turn into too giant to maintain increasing shortly. In 2012, for instance, Apple’s market capitalization was $500 billion and its inventory value had risen 68 % in simply eight months.

Again then, The New York Instances cited an analyst who used a spreadsheet, not a chatbot, to evaluate Apple’s prospects. The analyst concluded that if the corporate grew at simply 20 % a yr over the next decade — a lot slower than its development charge had been in 2012 — Apple could be value an not possible quantity by 2022: greater than $3 trillion. That quantity doesn’t look outlandish now.

Apple’s market cap isn’t fairly there but, but it surely’s shut, at about $2.7 trillion. Its outdated rival, Microsoft, which was a lot smaller than Apple in 2012, now has a market cap that surpasses $3 trillion. These two giants have risen and fallen many occasions and present each prospect of having the ability to take action once more.

I don’t know whether or not Nvidia belongs in that exalted class, but it surely’s clear that although Nvidia received’t be larger than your complete universe, it might find yourself being considerably extra helpful within the subsequent 10 or 20 years. Then once more, it may not.

It may very well be extra like Cisco Methods, essentially the most helpful firm within the inventory market in March 2000. That was the height of one other know-how increase — the dot-com bubble. Cisco remains to be a strong firm. Its merchandise make up the spine of the web. However its market capitalization in 2000 was $567 billion. Now, it’s round $200 billion.

It will likely be fascinating to observe Nvidia’s future unfurl. However as a result of I can’t predict the way it or any firm will fare in the long term, I don’t purchase particular person shares — not Nvidia, Apple, Microsoft, Cisco or anything.

As a substitute, I accept broad low-cost index funds that monitor your complete market. They’re a passive and fewer dangerous guess on the longer term that requires no inventory choosing.

If Nvidia grows quickly for years to come back, I received’t miss out fully as a result of the general inventory market will in all probability develop, too. If Nvidia falters, different shares are possible, sooner or later, to choose up the slack. That’s what has occurred over the previous 100 years, anyway. The A.I. increase is an exciting experience. If it begins to gradual, those that have hedged their bets might be happy that they did.