In case you are submitting tax returns, “the federal government already has your monetary info,” she added. “It’s actually obscure the rationale.”

Listed below are some questions and solutions in regards to the FAFSA and school monetary help:

What states have common FAFSA insurance policies?

Along with Louisiana, the place the coverage stays in place for this yr’s graduating class, no less than six different states have a requirement tied to commencement: Illinois, Alabama, Texas, California, Indiana and New Hampshire, in accordance with the attainment community. 4 states — Connecticut, Nebraska, New Jersey and Oklahoma — plan to require it beginning with the category of 2025, and Kansas is scheduled to start a requirement in 2028.

In New York, the finances simply accredited by the Legislature features a plan to require college districts to verify all college students full federal or state monetary help types, or signal a waiver stating that they’re “conscious of accessible help however select to not pursue it,” in accordance with a information launch from Gov. Kathy Hochul’s workplace. (College districts will implement the rule. If college students don’t fill out the appliance or decide out, they are going to nonetheless be capable to graduate.) The coverage takes impact in August, for the category of 2025.

What about monetary help packages this yr for graduating highschool seniors?

Due to the botched FAFSA replace, many college students and households are nonetheless ready for official monetary help presents, whilst the normal Could 1 deadline for committing to a school approaches. A survey of members of the Nationwide Affiliation of Scholar Monetary Support Directors this month urged that fewer than half of faculties had despatched out help presents to some or all accepted college students, and that 44 p.c had not begun packaging presents in any respect. Some colleges have prolonged their dedication deadlines to offer college students time to evaluation presents.

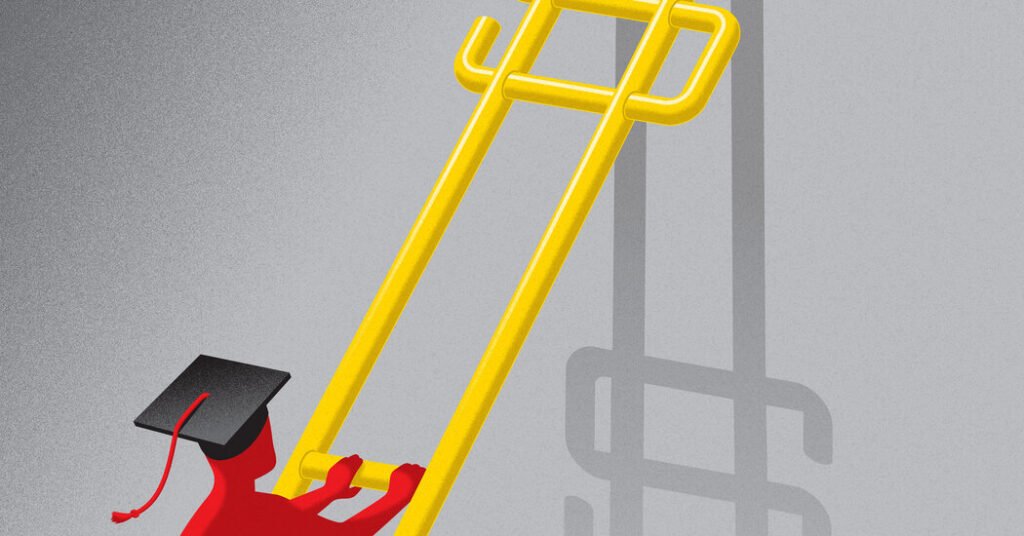

How a lot does it value to attend school?

The turmoil across the FAFSA comes amid rising concern about pupil debt and the price of attending school. The common printed, or “sticker,” worth for tuition, charges, housing and meals at a four-year non-public school was $56,190 for the 2023-24 college yr, in contrast with about $24,000 for an in-state pupil at a public school, in accordance with the School Board. The printed value of a yr at some non-public schools is quickly to succeed in $100,000, though most college students don’t pay full worth due to monetary help and reductions.