The Federal Reserve could have a housing drawback. On the very least, it has a housing riddle.

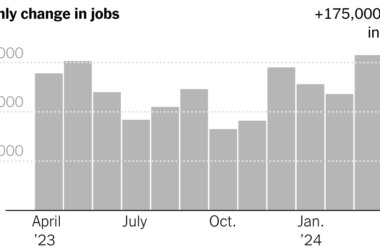

General inflation has eased considerably over the previous yr. However housing has proved a tenacious — and stunning — exception. The price of shelter was up 6 p.c in January from a yr earlier, and rose sooner on a month-to-month foundation than in December, in response to the Labor Division. That acceleration was an enormous motive for the pickup in total shopper costs final month.

The persistence of housing inflation poses an issue for Fed officers as they contemplate when to roll again rates of interest. Housing is by far the largest month-to-month expense for many households, which suggests it weighs closely on inflation calculations. Until housing prices cool, it is going to be exhausting for inflation as an entire to return sustainably to the central financial institution’s goal of two p.c.

“If you wish to know the place inflation goes, you want to know the place housing inflation goes,” mentioned Mark Franceski, managing director at Zelman & Associates, a housing analysis agency. Housing inflation, he added, “isn’t slowing on the charge that we anticipated or anybody anticipated.”

These expectations have been primarily based on private-sector information from actual property web sites like Zillow and Residence Record and different personal firms displaying that rents have barely been rising not too long ago and have been falling outright in some markets.

For house patrons, the mix of rising costs and excessive rates of interest has made housing more and more unaffordable. Many present owners, then again, have been partly insulated from rising costs as a result of they’ve fixed-rate mortgages with funds that don’t change from month to month.

Housing costs and mortgage charges don’t immediately present up in inflation information, nevertheless. That’s as a result of shopping for a house is an funding, not only a shopper buy like groceries. As a substitute, inflation information is predicated on rents. And with personal information displaying rents moderating, economists have been on the lookout for the slowdown to seem within the authorities’s information, as nicely.

Federal Reserve officers largely dismissed housing inflation for a lot of final yr, believing that the official information had merely been gradual to choose up on the cooling pattern obvious within the personal information. As a substitute, they centered on measures that exclude shelter, an strategy they noticed as higher reflecting the underlying developments.

However because the divergence has continued, some economists inside and out of doors the Fed have begun to query these assumptions. Economists at Goldman Sachs not too long ago raised their forecast for housing inflation this yr, citing rising rents for single-family properties.

“There’s clearly one thing that’s taking place that we don’t but perceive,” Austan Goolsbee, president of the Federal Reserve Financial institution of Chicago, mentioned in a latest interview. “They ask me, ‘What are you watching?’ I’d say, ‘I’m watching housing as a result of that’s the factor that’s nonetheless bizarre.’”

Lagging Knowledge

The cussed nature of housing inflation isn’t a complete thriller. Economists knew it might take time for the moderation in rents seen in private-sector information to make its method into the Labor Division’s official Client Worth Index.

There are two causes for that delay. The primary is technical: The federal government’s information is predicated on a month-to-month survey of hundreds of rental models. A given unit is surveyed solely as soon as each six months, nevertheless. So if an condo is surveyed in January and the lease goes up in February, that enhance received’t present up within the information till the condo is surveyed once more in July. That causes the federal government information to lag behind circumstances, particularly in periods of fast change.

The second motive is conceptual. Most personal indexes embody leases solely once they get new tenants. However the authorities goals to seize housing prices for all tenants. As a result of most leases final a yr or longer, and since those that renew their leases usually get a reduction relative to individuals renting on the open market, the federal government’s information will sometimes modify extra regularly than the personal indexes.

The private and non-private information ought to finally converge. But it surely isn’t clear how lengthy that course of will take. The fast rise in rents in 2021 and 2022, for instance, led many individuals to remain put quite than wading into the red-hot rental market. That, amongst different elements, could have made it take longer than common for market rents to filter into the federal government information.

There are indicators {that a} slowdown is underway. Rents have risen at an annual charge of lower than 5 p.c over the previous three months, down from a peak of near 10 p.c in 2022. Non-public information sources disagree on how a lot rental inflation nonetheless has to ease, however they agree that the pattern ought to proceed.

“For probably the most half, they’re all saying the identical factor, which is that lease inflation has moderated considerably,” mentioned Laura Rosner-Warburton, senior economist at MacroPolicy Views, an financial analysis agency.

Homes vs. Residences

Whereas rental inflation could lastly be moderating, the federal government’s measure of prices for owners has not adopted go well with; it really accelerated within the newest month’s information. And since extra Individuals personal their properties than lease, owner-occupied housing dominates the shelter part of the Client Worth Index.

The bills that most individuals affiliate with homeownership — mortgage funds, owners’ insurance coverage, upkeep and repairs — aren’t immediately included in inflation measures.

As a substitute, the federal government measures housing inflation for homeowners by assessing how a lot it might value to lease an identical house, an idea often known as homeowners’ equal lease. (The thought is that this measures the worth of the “service” of offering a house, as distinct from the funding good points from proudly owning it.)

The rental and possession measures ordinarily transfer collectively as a result of they’re primarily based on the identical underlying information — the survey of hundreds of rental models. However to calculate the possession figures, the Labor Division offers better weight to properties which might be similar to owner-occupied models. That signifies that if several types of housing behave in a different way, the 2 measures can diverge.

That could possibly be what is occurring now, some economists say. A increase in condo development lately has helped carry down rents in lots of cities. Single-family properties, although, stay in brief provide simply as tens of millions of millennials are reaching the stage the place they need more room. That’s driving up the price of homes for each patrons and renters. And since most householders dwell in single-family properties, single-family models play an outsize function within the calculation of homeowners’ equal lease.

“There’s extra warmth behind single-family, and there’s excellent arguments to be made for why that warmth will persist,” mentioned Skylar Olsen, chief economist at Zillow.

A Fluke, or One thing Extra?

Different economists doubt that the uptick in inflation in January is the beginning of a extra lasting pattern. Single-family house rents have been outpacing condo rents for some time now, but solely not too long ago has inflation for homeowners and renters diverged. That means that the January information was a fluke, argued Omair Sharif, founding father of Inflation Insights, an financial analysis agency.

“The month-to-month stuff basically might be uneven,” Mr. Sharif mentioned. The excellent news within the report, he mentioned, is that lease progress has lastly begun to chill, making him extra assured that the long-awaited slowdown is rising within the official information.

That conclusion is way from sure, nevertheless. Earlier than the pandemic, totally different components of the housing market advised usually constant tales: Rents for residences rose at roughly the identical charge as these for single-family properties, for instance.

However the pandemic destroyed that equilibrium, driving rents up in some locations and down in others, disrupting relationships between the totally different measures. That makes it exhausting to be assured about when the official information will cool, or by how a lot — which might make the Fed extra cautious because it considers reducing rates of interest, mentioned Sarah Home, senior economist at Wells Fargo.

“Proper now, they’re nonetheless assuming that there’s nonetheless plenty of disinflation within the pipeline, but it surely’s going to maintain them guarded of their optimism,” she mentioned, referring to Fed officers. “They do have to consider the place shelter really lands, and the way lengthy it takes to get there.”

Audio produced by Tally Abecassis.