The Financial institution of England held rates of interest on the highest stage in 16 years, whilst inflation in Britain has fallen to its slowest tempo in additional than two years.

On Thursday, policymakers on the central financial institution left their key charge at 5.25 % for the fifth consecutive assembly. The choice to carry was extensively anticipated, however analysts had been monitoring the votes by the nine-person rate-setting committee to see if a consensus was rising about whether or not value will increase had been underneath management and when charge cuts could start.

Eight members of the committee voted to carry charges, with the 2 policymakers who voted for greater charges final month dropping their stance. One member voted to chop charges.

The Financial institution of England held charges “as a result of we have to ensure that inflation will fall again to our 2 % goal and keep there,” Andrew Bailey, the governor of the central financial institution, stated in a press release. “We’re not but on the level the place we will minimize rates of interest, however issues are shifting in the suitable course.”

Financial coverage wanted to be “restrictive for an prolonged interval,” in response to the minutes of this week’s assembly. However, officers added, coverage may stay restrictive even after rates of interest had been lowered, offering the clearest sign thus far that charge cuts had been on their means.

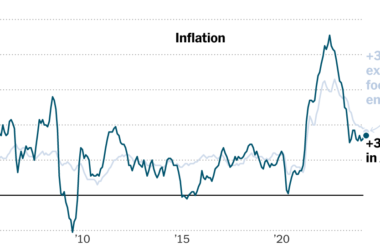

For a lot of final 12 months, inflation in Britain was stubbornly excessive. Costs rose sooner than in neighboring European nations and a good labor market pushed up wages. These considerations have not too long ago began to ease. Information revealed on Wednesday confirmed that the annual charge of inflation dropped to three.4 % final month, down from 4 % in January and the bottom studying since September 2021.

Economists count on inflation to gradual sharply over the subsequent few months, probably going beneath the central financial institution’s goal of two %, as family vitality payments fall. Core inflation, which strips out meals and vitality costs that are typically extra risky and influenced by worldwide costs, dropped to 4.5 % final month, the bottom in additional than a 12 months. On the similar time, the weak spot of the financial system has put strain on the central financial institution to chop charges. Britain ended final 12 months in a recession.

Policymakers have warned that the impression of decrease vitality costs will ultimately fade and the speed of inflation will go greater once more. Somewhat than simply touching 2 %, policymakers wish to ensure they will return inflation to that charge over an extended interval earlier than chopping rates of interest.

So officers have been intently watching wage information to see if rising pay packets are seeding longer-term inflationary pressures. Annual pay progress, excluding bonuses, rose 6.1 % within the three months to January, the newest information confirmed.

The controversy over the timing of rate of interest cuts is preoccupying policymakers at a number of main central banks. On Wednesday, U.S. Federal Reserve officers held charges regular however stated they nonetheless anticipated to make a number of charge cuts this 12 months. The identical day, Christine Lagarde, the president of the European Central Financial institution, stated that by June, eurozone policymakers would have extra information, significantly on wages, to offer them confidence that inflation was underneath management, fueling hypothesis that charge cuts may start in the summertime.

Earlier on Thursday, the Swiss Nationwide Financial institution unexpectedly minimize rates of interest, the primary to maneuver amongst central banks in superior economies. Inflation peaked at about 3.5 % in Switzerland, a lot decrease than elsewhere in Europe, and has been beneath 2 % for a number of months. The energy of the Swiss franc was additionally a consideration within the determination to chop charges, officers stated. A powerful foreign money is usually a drag on the financial system by making exports costlier — after the speed transfer, the franc fell sharply towards the euro and greenback.

Officers on the Financial institution of England have been break up on the best way to sort out excessive inflation for some time. Swati Dhingra, who once more voted to chop charges, has argued that the weak spot of the British financial system implies that inflation would come down and that the final charge will increase might need been extreme and would must be reversed extra forcefully.

Final month, Jonathan Haskel and Catherine L. Mann, voted to lift charges, emphasizing the tightness of the labor market and the danger of deeply embedded inflationary pressures. However they each deserted that place this month, and joined the bulk to carry charges.

Nonetheless, all eight members who voted to carry charges stated they wanted to see extra proof concerning the persistence of inflation earlier than loosening the financial institution’s coverage stance.