Firstly of 2024, traders anticipated the Federal Reserve to chop rates of interest considerably this yr as inflation cooled. However value will increase have been surprisingly cussed, and that’s forcing a rethink on Wall Road.

Buyers and economists are questioning when and the way a lot Fed policymakers will handle to chop charges — and a few are more and more doubtful that Fed officers will handle to decrease them in any respect this yr.

Inflation was coming down steadily in 2023, however that progress has stalled out in 2024. The Fed’s most popular inflation index climbed 2.8 p.c in March from a yr earlier, after stripping out unstable meals and gas prices, knowledge on Friday confirmed. Whereas that’s down considerably from a 2022 peak, it’s nonetheless nicely above the central financial institution’s 2 p.c aim.

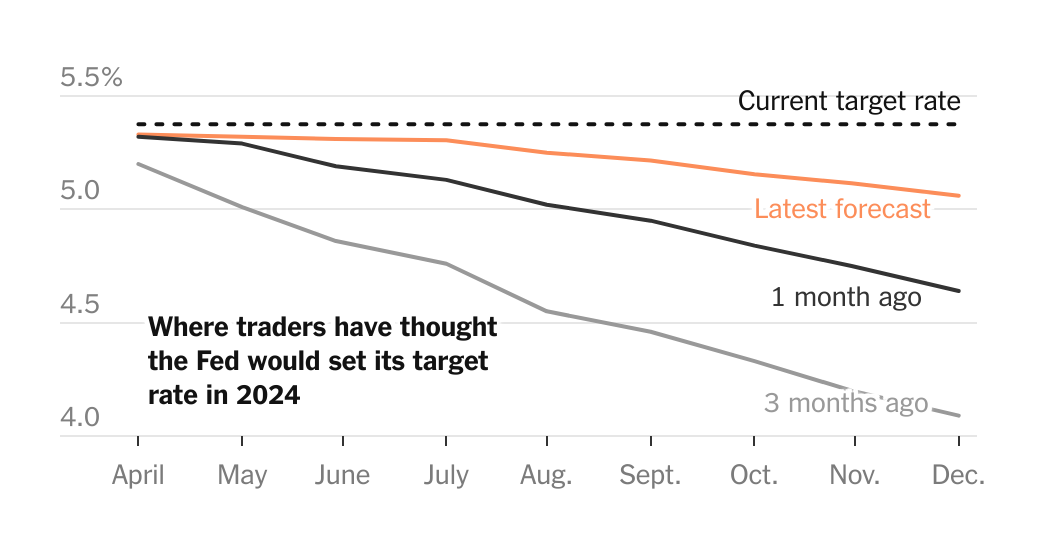

Inflation’s stickiness has prompted Fed officers to sign that it could take longer to scale back rates of interest than that they had beforehand anticipated. Policymakers raised rates of interest to five.33 p.c between March 2022 and final summer time, and have held them there since. Buyers who got here into the yr anticipating a primary charge reduce by March have pushed again these expectations to September or later.

Some analysts are even starting to query whether or not the Fed’s subsequent transfer may be to lift charges, which might be an enormous reversal after months through which Wall Road overwhelmingly anticipated the Fed’s subsequent step to be a reduce.

However most economists suppose that it will take rather a lot for the Fed to change gears that drastically.

“It’s actually a doable final result, however it will require an outright acceleration within the inflation charge,” mentioned Matthew Luzzetti, chief U.S. economist at Deutsche Financial institution.